Understanding Foreclosure: Causes, Process, and Solutions

Understanding Foreclosure: Causes, Process, and Solutions

Foreclosure is a challenging situation that many homeowners may face. Understanding the causes, the process, and the potential solutions can help individuals navigate this difficult time more effectively. This blog will explore the reasons for foreclosures, the steps involved in the foreclosure process, and ways to remedy a foreclosure, including the benefits of using a realtor to sell the property before foreclosure. (My name is Jessica Salinas, San Antonio and surrouding area realtor, and I am happy to provide some insightful information. Feel free to reach out to me at anytime with questions for a realtor.)

Reasons for Foreclosures

Foreclosure occurs when a homeowner fails to make mortgage payments, leading the lender to take legal action to repossess the property. Several factors can contribute to this situation:

1. Financial Hardship: Job loss, medical expenses, or other unexpected financial burdens can make it difficult for homeowners to keep up with mortgage payments.

2. Adjustable-Rate Mortgages (ARMs): Homeowners with ARMs may experience significant increases in their monthly payments, leading to affordability issues.

3. Divorce or Separation: The financial strain of a divorce or separation can lead to missed mortgage payments if the household income decreases.

4. Underemployment: Even if a homeowner is employed, a reduction in hours or wages can impact their ability to pay the mortgage.

5. Unexpected Expenses: Major repairs or other unexpected expenses can strain a homeowner’s budget, leading to missed payments.

The Foreclosure Process

The foreclosure process varies by state, but generally follows these steps:

1. Missed Payments: The process begins when a homeowner misses one or more mortgage payments. Lenders typically send a notice of default after 90 days of missed payments.

2. Notice of Default: The lender sends a formal notice of default, giving the homeowner a specific period to catch up on payments (usually 90 days).

3. Pre-Foreclosure: If the homeowner cannot catch up on payments during the notice of default period, the property enters pre-foreclosure. At this stage, the homeowner can still negotiate with the lender to find a solution.

4. Public Notice: The lender files a public notice with the County Recorder’s Office, announcing the intent to foreclose. This begins the official foreclosure process.

5. Auction: If the homeowner fails to resolve the default, the property is scheduled for a public auction. The highest bidder becomes the new owner.

6. Post-Foreclosure: If the property does not sell at auction, it becomes an REO (Real Estate Owned) property, and the lender takes ownership.

Remedies for Foreclosure

Facing foreclosure can be daunting, but there are several ways homeowners can remedy the situation:

1. Loan Modification: Homeowners can negotiate with their lender to modify the terms of their loan, such as extending the repayment period or reducing the interest rate.

2. Forbearance: This is a temporary reduction or suspension of mortgage payments, allowing homeowners time to improve their financial situation.

3. Repayment Plan: Homeowners can arrange a plan with the lender to repay the missed payments over a specified period.

4. Short Sale: Selling the property for less than the mortgage balance with the lender’s approval can prevent foreclosure.

5. Deed in Lieu of Foreclosure: The homeowner voluntarily transfers ownership of the property to the lender to avoid foreclosure.

6. Bankruptcy: Filing for bankruptcy can provide temporary relief from foreclosure, giving homeowners time to reorganize their finances.

Using a Realtor to Sell Before Foreclosure

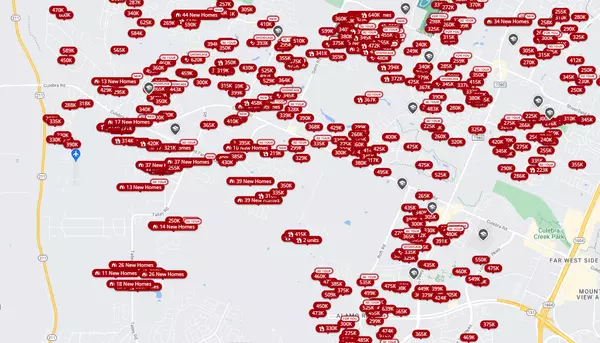

One of the most effective ways to avoid foreclosure is to sell the property before it goes to auction. Here’s how realtor like myself can help:

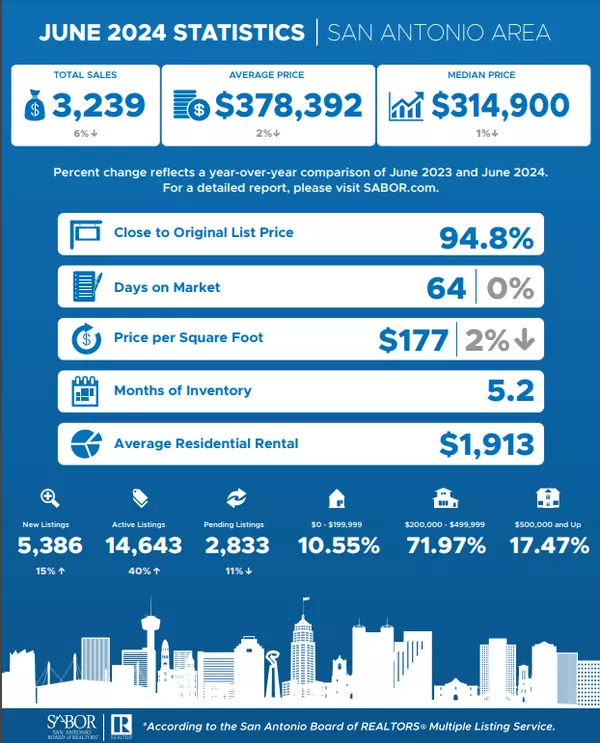

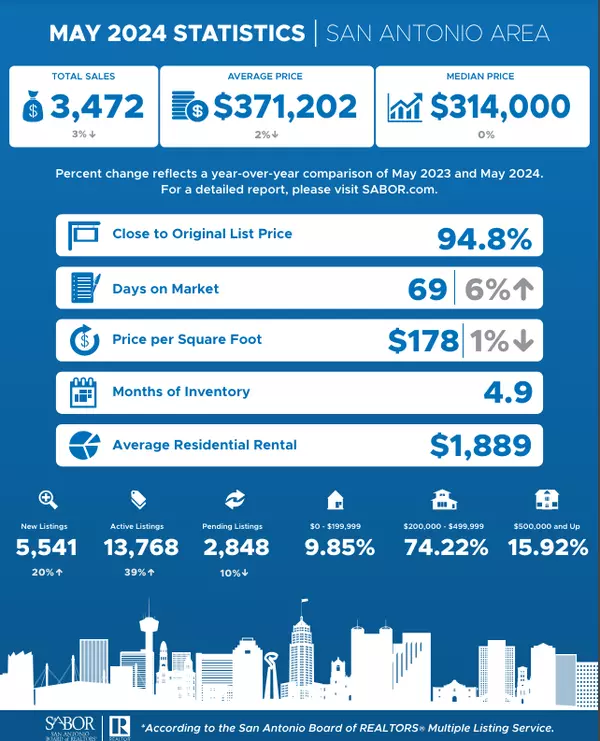

1. Market Expertise: A realtor can assess the market value of your property and set a competitive price, increasing the likelihood of a quick sale.

2. Marketing: Realtors have access to various marketing channels and can showcase your property to a broad audience, attracting potential buyers.

3. Negotiation: A realtor can negotiate with buyers and the lender to ensure the sale proceeds smoothly and any outstanding mortgage balance is settled.

4. Paperwork: The foreclosure process involves a significant amount of paperwork. A realtor can handle the documentation, ensuring all legal requirements are met.

5. Peace of Mind: Working with a realtor can alleviate some of the stress associated with foreclosure, providing professional guidance and support throughout the process.

Foreclosure is a difficult situation, but understanding the causes, process, and potential solutions can help homeowners take proactive steps to protect their property and financial well-being. If you’re facing foreclosure, consider reaching out to a realtor for assistance in exploring your options and finding the best solution for your circumstances.

Reach out to me for a FREE home price analysis, 512-762-8324 Jessica Salinas

Recent Posts

"Our realtor Jessica Salinas was very helpful knowledgeable and ready to help us in any way she could this was an experience that truly without her help would have never happened

She is a beautiful and a warm hearted hard working person not just interested in just the selling of the property but making you feel at ease with everything during the process. If anyone is looking to buy I would definitely look her up !!!!!! " -Judy

GET MORE INFORMATION